- The Jollof Diary

- Posts

- Correction: Download Error in Last Email 🙏🏾

Correction: Download Error in Last Email 🙏🏾

Apologies, issue with the download link has been fixed now

Out now!!

Greetings 🌇

Resending this due to a download error in the initial email. If you were able to access the report earlier, please ignore this email. If not, you can access it now.

So weeks ago, we launched our very first physical magazine/report on how Nigerian users streamed music on Spotify in the first half of 2024, alongside other events in the music business during that period. While the external support has been overwhelming—we ran out of printed copies almost immediately — there’s no way we’ll make such a pivot without bringing you along. I mean, your support over the years has been humbling, and it's why we’re opening access because you deserve it even more.

This general release is our way of giving back and saying thank you for sticking with us, engaging our work, and even recommending us. We do not take it for granted, and I hope you enjoy the insights from this report as much as we enjoyed preparing it for you.

Since January, we’ve been nose-to-the-grindstone, studying and documenting how music consumers in Nigeria 🇳🇬—West Africa’s powerhouse—have adapted to streaming, and comparing that to South Africa 🇿🇦 and Egypt 🇪🇬, leaders in Southern & Northern Africa respectively.

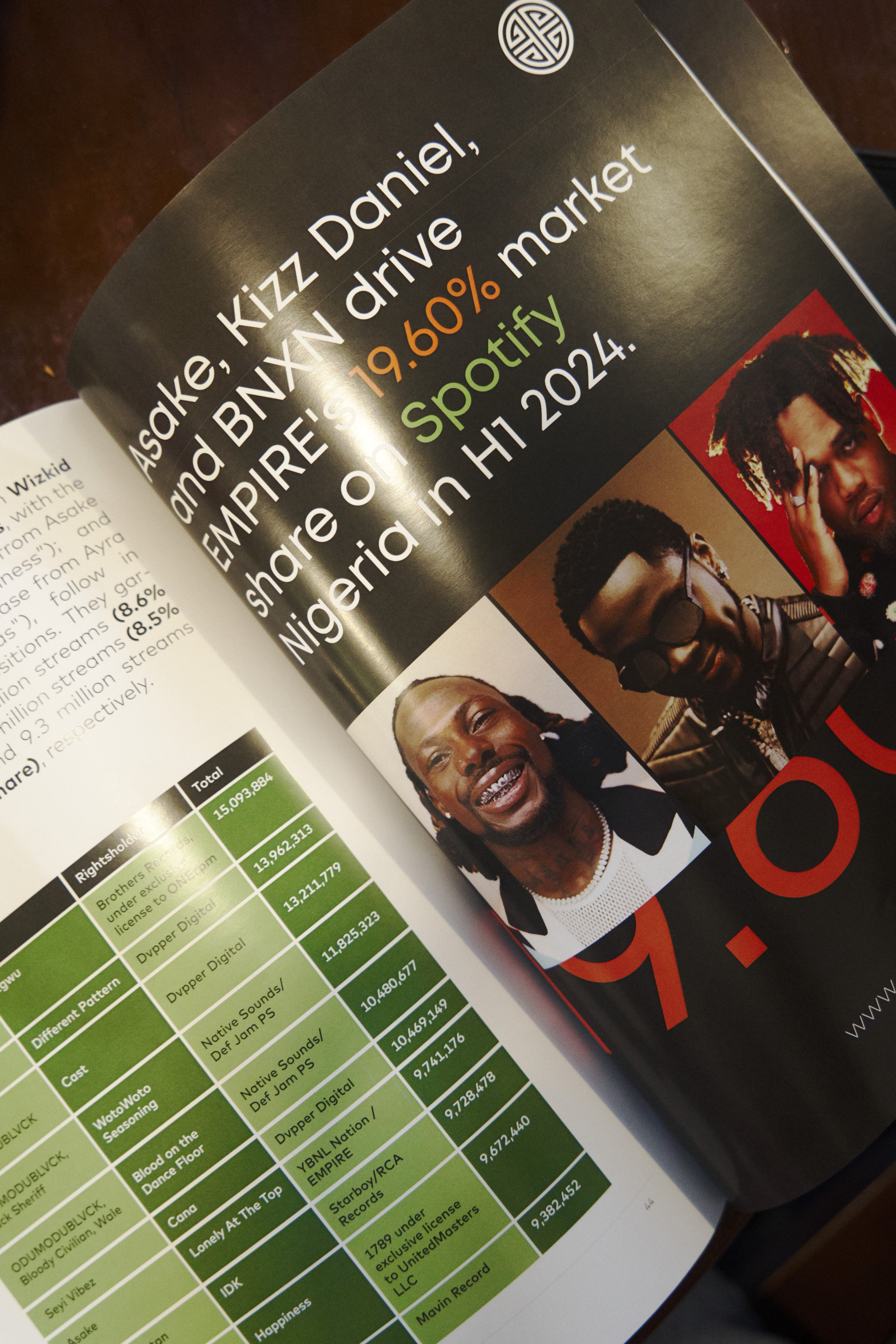

This report highlights the top 10 rightsholders, with EMPIRE (19.60%), DAPPER (16.16%), and Mavin Records (6.27%) leading the pack in Nigeria. It also details rightsholders’ market shares across the top 10 most-streamed songs, alongside the releases and artists that drove these performances in the first half of 2024.

One of the most exciting revelations for me was seeing Nigerian music consumers contribute nearly a billion streams to Spotify in just six months, far outpacing South Africa and Egypt in stream count. However, South Africa remains the revenue giant in Sub-Saharan Africa, contributing 77% of the region’s revenue, according to IFPI.

Another standout from this report is how it challenges the often-cited notion that "low internet penetration" is the primary reason for Nigeria’s revenue shortfall. While this is certainly a factor, especially with a population of 200 million, the real story lies in Nigeria’s macroeconomic realities, like severe currency devaluation and depleting purchasing power. Our findings show a record-high drop in the value of Nigerian Naira subscriptions (-74.89% over the past three years) on Spotify, compared to declines in South Africa (-30.6%) and Egypt (-66.98%).

This report is a must-have for anyone interested in the music business or the broader Creator Economy—whether you're an insider, an investor, or simply an enthusiast. I can’t wait for you to dive in!

THE WHY...

The Nigerian music industry, though still nascent, has really matured in the last few years. Major shifts—both industry-specific and macroeconomic—are shaping the ecosystem, and it’s important that our reportage, as an industry, reflects this growth. At The Jollof Diary, we’ve been at this for about half a decade, with first-hand experience of the Nigerian music industry’s coming of age - especially with streaming.

As an EXTERNAL PARTY — If you’re an investor eyeing the Nigerian music industry, you need a clear picture of who’s leading, who to invest in, and where the opportunities lie. You need hard data—not just opinions and sentiments—about the state of the industry and how consumers are engaging with music. This report serves that, tipping The Jollof Diary as a key resource for navigating the music business and the broader Creator Economy.

As INTERNAL PARTY — Within the industry, there’s hardly enough understanding of the metrics that drive success and market share. For instance, how many streams does a company need to achieve per quarter to secure a top 3 market share in Nigeria?

This report sheds light on crucial metrics for music companies, enabling teams to make more informed projections and strategies for subsequent release periods. While global recognition is important, the music business is at an intriguing juncture where local success [read: regionality] remains vital. The role of regional markets and cultures can no longer be overlooked, and we’ve ensured this report is as localized as possible.

This pivot was made with you in mind, and I’d love to hear your thoughts and feedback once you get a chance to go through it.

FRIENDLY ADVICE...

I hear the magazine is perfect for a good digital detox over coffee. So, if you visit the Alliance Française library or Rap Joint in Ikoyi, you have some great company.

See you tomorrow? 🤗